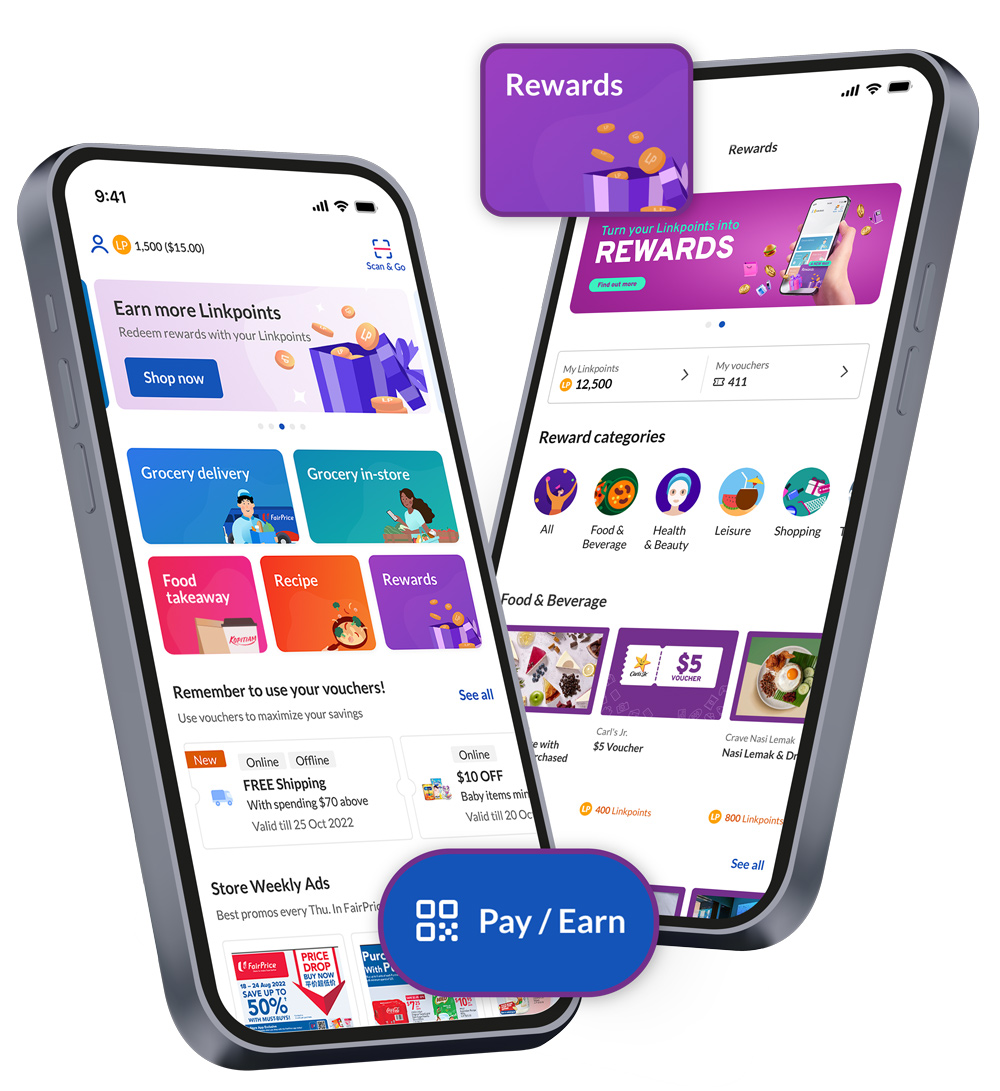

Get more of what you love on the FairPrice Group app

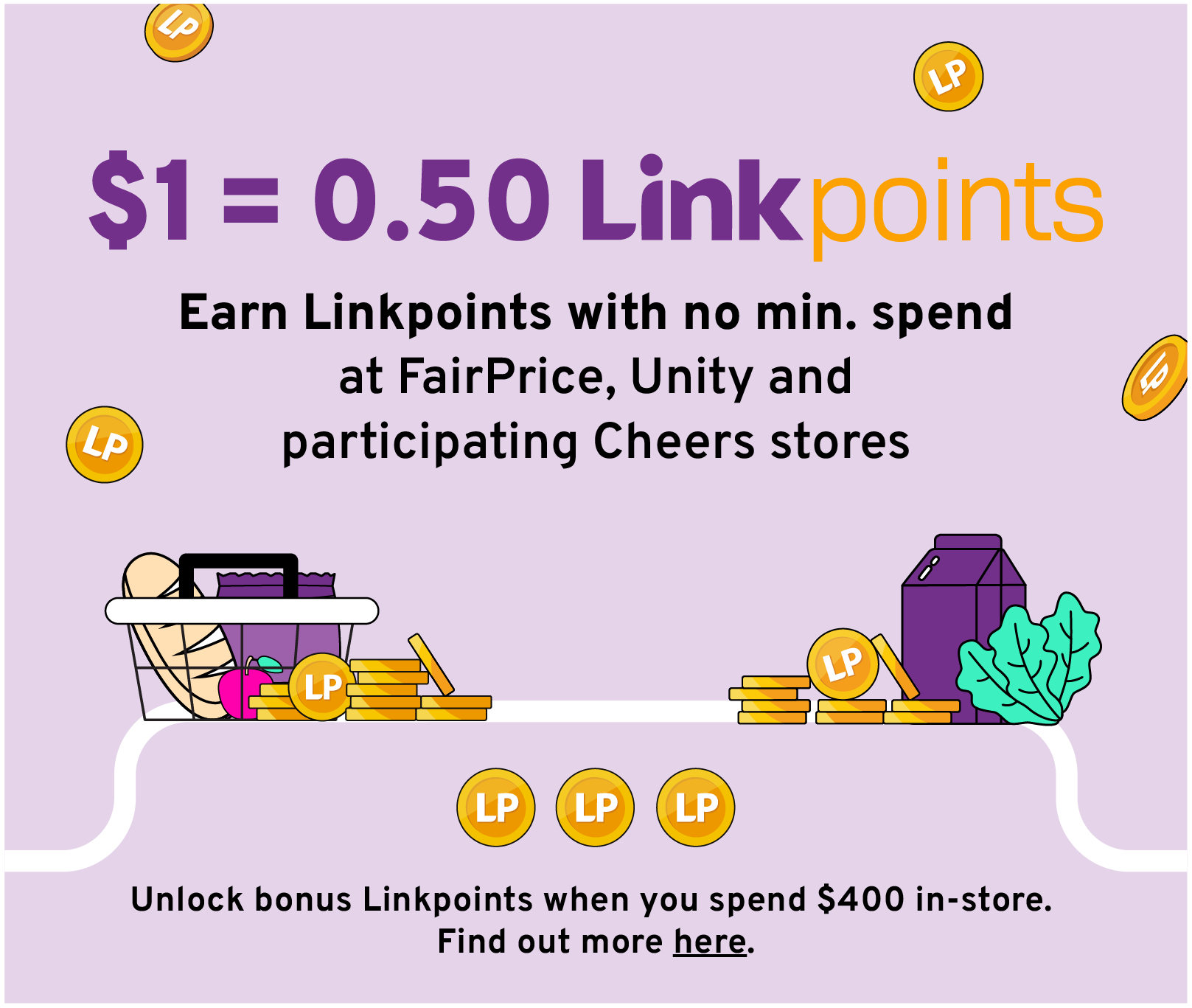

The FairPrice Group app brings you closer to a more rewarding life at your fingertips. Earn and redeem Linkpoints, turn Linkpoints into exclusive rewards, and manage Linkpoints on the go.

Download appGet LinkpointsRedeem rewards

Explore Member Benefits

Sign up as a member for FREE and be the first to know about all the best promotions! You can get first dibs on exclusive deals to enjoy even greater value every day.

Learn MoreWhat's New?

Check out the latest promotions from our partners.